End-of-Life Planning Most Important To Fathers: New Everplans Study

As we celebrate our fathers, a new Everplans study reports that end-of-life planning is at the top of their responsibilities list.

Other top findings include:

- As fathers age, responsibilities shift with fathers taking on end of life planning tasks as they get older and younger fathers taking on less traditional male responsibilities

- Most fathers believe they will leave loved ones at best searching for or worse losing needed beneficiary documents

- Lack of end of life planning, especially among younger fathers, can result in major losses to loved ones and tremendous gains for government trustees who hold $41 billion in unclaimed assets*

Full PRNewswire Release:

NEW YORK (June 13, 2014) — As families celebrate Father's Day, leading lifespan planner, Everplans.com commissioned consumer market researcher Harris Poll to field an inaugural "A Father's Responsibility?" survey of more than 2,000 U.S. households to reveal prevailing responsibilities and expectations of fatherhood. The findings from the survey, conducted online in June 2014, show that end of life planning is one of the most important responsibilities for married men (young and old) to take on. The survey also found that the responsibilities assumed by married men tend to change over time. While fathers tend to take on more traditionally female-oriented responsibilities when they're younger, they assume end of life planning as they get older. Still, the findings show that while fathers consider end of life planning one of their top responsibilities, they do not believe that they do it "very well," which may create a potentially catastrophic financial situation for the families.

End-Of-Life Planning Is A Top Priority For Married Men

Overall, the findings show that married men consider end of life planning (and long term financial planning) to be in the top three of their "responsibilities" list whereas married women tend to claim more conventional motherly duties such as cleaning the home, caring for children, and social planning. Paying bills, however, breaks into the top 5 of married women's named responsibilities.

Top 5 Responsibilities (Married Men vs Married Women)

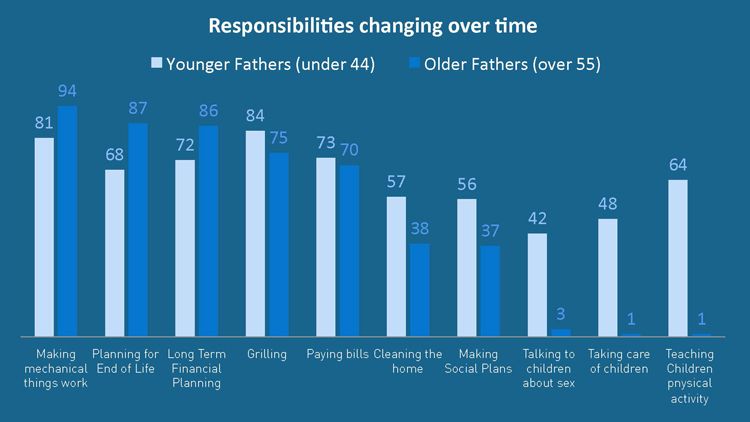

Responsibilities Change Over Time

These responsibilities change significantly as they get older. Younger fathers (under 44 yrs old) take on more of the traditionally female responsibilities and older fathers (aged 55+) take on more of what is considered to be socially taboo responsibilities – death and money.

Responsibilities (Younger Fathers vs Older Fathers)

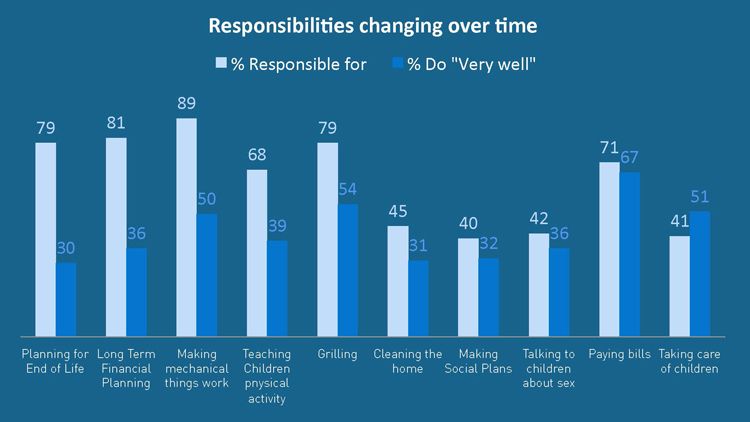

Only 1 In 3 Fathers Believe They Do End-Of-Life Planning 'Very Well'

Contrasting what fathers claim as their responsibility with what they claim to do very well, fathers are very comfortable with their skills in most areas. However, only 1 in 3 fathers believe they do end of life planning 'very well.'

Responsibilities And Perceived Performance

Commenting on the survey, Abby Schneiderman, Co-Founder at Everplans.com, said: "On Father's Day, we celebrate all the significant contributions that fathers have made in each of our lives. They take on so many responsibilities and seem to be doing them as best as they can. Our inaugural study conducted by Harris Poll shows that end of life planning is an area where they are not confident and may need help. We commend fathers (and mothers) for taking on this difficult responsibility but, without the proper provisions in place, they unintentionally create the risk of leaving a mess behind for families."

Lack Of End-Of-Life Planning Can Result In Major Loss

While most fathers saw themselves as being responsible for end of life planning, they believed that they will leave loved ones at best searching for or worse, losing needed beneficiary documents. According to the findings, less than one-third of fathers said that their family knew exactly where their plans/documents are.

Lack of communication with other family members by fathers risk losing valuable assets that are left in unclaimed bank accounts, safe deposit boxes and pensions. In fact, the National Association of Unclaimed Property Administrators (NAUPA) recently found that the U.S. government is currently holding over $41 billion in unclaimed assets. In addition, more than $300 million in pension benefits are owed to over 38,000 people (according to Pension Benefit Guaranty Corp) and 1 in 600 people may be owed life insurance money (according to Consumer Reports).

"Fathers and mothers, especially Baby Boomers and the Silent Generation, owe it to their families to adequately plan for end-of-life situations," said James Firman, National Council on Aging President and CEO. "It is important to make sure that their wishes and preferences are clear, and that their important documents can be easily located, so that their families and loved ones can be fully prepared."

Methodology

This survey was conducted online within the United States by Harris Poll on behalf of Everplans.com from June 4-6, 2014 among 2,036 adults ages 18 and older, of which 539 are fathers. This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated.

For complete survey methodology, including weighting variables, please contact William Charnock, Chief Marketing Officer at Everplans.com at william@everplans.com or 646-658-3665.

About Everplans

Everplans helps you complete, organize and securely share your legal, financial and health planning in one place so the important people in your life will have easy access when they most need it. The company was founded by Adam Seifer and Abby Schneiderman, entrepreneurs with a passion for helping people and a proven track record of creating successful online communities. For more information, please visit www.everplans.com.